When it comes to managing finances, every penny counts. This sentiment rings especially true when it comes to paying taxes. For residents of Kirklees, there’s a beacon of hope amidst the financial responsibilities – the Kirklees Council Tax Rebate.

Understanding Kirklees Council Tax Rebate

What is Kirklees Council Tax Rebate?

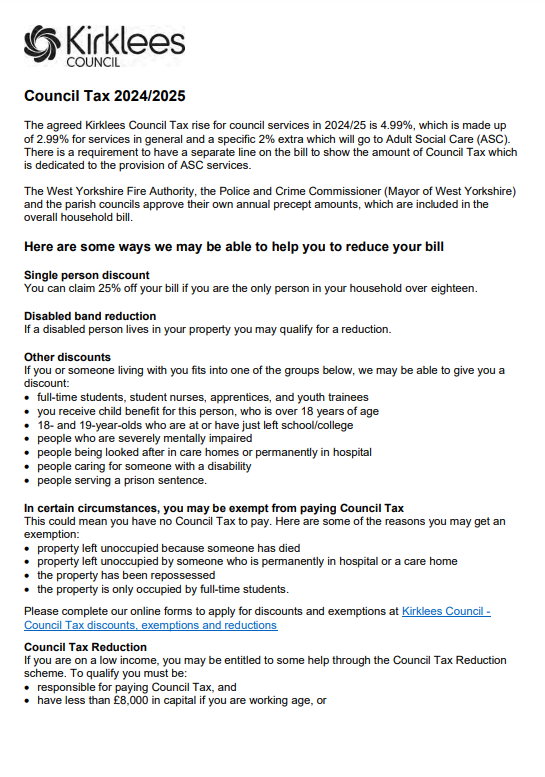

Kirklees Council Tax Rebate is a financial relief program designed to assist eligible residents in managing their council tax payments. It serves as a form of assistance provided by the local government to alleviate the financial burden on households.

Eligibility Criteria for Kirklees Council Tax Rebate

To qualify for the Kirklees Council Tax Rebate, individuals must meet specific criteria set forth by the local authorities. Typically, eligibility is based on factors such as income level, household composition, and property ownership status.

How to Apply for Kirklees Council Tax Rebate

Online Application Process

The most convenient way to apply for Kirklees Council Tax Rebate is through the online portal provided by the local council. Applicants can fill out the necessary forms and submit required documentation electronically, streamlining the application process.

Paper Application Process

For those who prefer traditional methods, paper applications are also available. Applicants can request forms from the local council office or download them from the official website. Once completed, these forms can be submitted via mail or in person.

Required Documentation

Regardless of the application method chosen, applicants must provide supporting documentation to verify their eligibility. This may include proof of income, residency status, and property ownership.

Benefits of Kirklees Council Tax Rebate

Financial Relief

The primary benefit of Kirklees Council Tax Rebate is the financial relief it provides to eligible households. By reducing the amount of council tax owed, the rebate helps stretch limited budgets further.

Support for Low-Income Families

For low-income families struggling to make ends meet, the rebate can be a lifeline. It ensures that essential funds are not diverted away from necessities like food, utilities, and healthcare.

Stimulating Local Economy

By putting money back into the hands of residents, Kirklees Council Tax Rebate stimulates the local economy. Increased consumer spending can have a ripple effect, benefiting businesses and communities alike.

Impact of Kirklees Council Tax Rebate

Alleviating Financial Burden

For many residents, council tax payments can be a significant financial burden. The rebate program helps alleviate this burden, allowing individuals and families to allocate funds towards other essential expenses.

Promoting Social Equity

By providing financial assistance to those in need, Kirklees Council Tax Rebate promotes social equity within the community. It ensures that individuals facing financial hardship receive the support they require to maintain a decent standard of living.

Strengthening Community Ties

The presence of programs like Kirklees Council Tax Rebate fosters a sense of community solidarity. Knowing that their neighbors are receiving assistance can encourage individuals to support one another during challenging times.

Tips for Maximizing Kirklees Council Tax Rebate

Keeping Records Updated

It’s essential to keep personal and financial records updated to ensure smooth processing of rebate applications. Changes in income, household composition, or residency status should be promptly reported to the local council.

Exploring Additional Assistance Programs

In addition to Kirklees Council Tax Rebate, residents may qualify for other assistance programs offered by local authorities or charitable organizations. It’s worth exploring all available options to maximize financial support.

Seeking Professional Guidance

For individuals unsure about their eligibility or the application process, seeking professional guidance can be beneficial. Local council offices often provide assistance and guidance to help applicants navigate the rebate process successfully.

Conclusion

In conclusion, Kirklees Council Tax Rebate serves as a beacon of financial relief for residents facing the challenges of managing their council tax payments. By understanding the eligibility criteria, exploring the application process, and seeking assistance when needed, individuals and families can access the support they require to alleviate financial burdens and maintain a decent standard of living.

Whether it’s through online applications, paper forms, or seeking professional guidance, the path to unlocking savings with Kirklees Council Tax Rebate is within reach. By maximizing available resources and staying informed about additional assistance programs, residents can navigate the complexities of council tax payments with confidence.

Download Kirklees Council Tax Rebate

Frequently Asked Questions

- How much can I expect to receive through Kirklees Council Tax Rebate?

- The amount of rebate received varies depending on individual circumstances, including income level and property valuation.

- Can I apply for the rebate if I rent my property?

- Yes, renters may also be eligible for Kirklees Council Tax Rebate, provided they meet the necessary criteria.

- Is there an age restriction for eligibility?

- No, Kirklees Council Tax Rebate eligibility is not restricted by age. Applicants of all ages may qualify based on income and household composition.

- Will applying for the rebate affect other benefits I receive?

- In most cases, receiving Kirklees Council Tax Rebate will not affect eligibility for other benefits. However, it In most cases, receiving Kirklees Council Tax Rebate will not affect eligibility for other benefits. However, it’s advisable to consult with relevant authorities or benefit providers to ensure there are no adverse impacts.

- What should I do if my application is denied?

- If your application for Kirklees Council Tax Rebate is denied, don’t lose hope. You have the right to appeal the decision. Gather any additional documentation or evidence that supports your eligibility and submit it as part of the appeals process.