Citibank Drivers Edge – Citibank’s Driver’s Edge program was tailored for those who spend a significant amount on automobile-related expenses. Whether you’re filling up your gas tank, getting your car serviced, or even purchasing a new vehicle, this program aimed to give you rewards that could be redeemed towards these expenses.

What is Citibank Drivers Edge?

Citibank Drivers Edge is a credit card designed to reward drivers for their everyday expenses. It’s not just about making purchases; it’s about earning points that can be redeemed for a variety of rewards, from statement credits to travel vouchers.

Benefits of Citibank Drivers Edge

One of the standout features of this card is the flexibility it offers. Whether you’re filling up your gas tank or grabbing a coffee on your way to work, you’ll earn points that can add up quickly. Plus, with no annual fee, it’s a low-cost option for those looking to maximize their rewards.

How Does Citibank Drivers Edge Work?

Earning Points

Every time you use your Citibank Drivers Edge card, you’ll earn points based on the amount you spend. The more you use your card, the more points you’ll accumulate. Plus, there are often bonus point opportunities, like special promotions or partner offers, that can help you earn even faster.

Redeeming Points

Once you’ve earned enough points, you can start redeeming them for rewards. From cashback to travel vouchers, there’s something for everyone. And with a simple redemption process, you’ll be enjoying your rewards in no time.

Key Features of Citibank Drivers Edge

1. No Annual Fee:

- Citibank Driver’s Edge stands apart from many rewards cards by not charging an annual fee. This allows cardholders to enjoy the card’s benefits without any yearly cost.

2. Competitive Interest Rates:

- The card offers competitive interest rates, making it an attractive option for those who may carry a balance from month to month. Responsible use can also contribute to building or improving your credit history.

3. Additional Perks and Rewards:

- Travel Insurance: When you book trips using the Driver’s Edge card, you may be eligible for travel insurance. This coverage can include benefits like trip cancellation, lost luggage reimbursement, and emergency medical assistance.

- Purchase Protection: Items purchased with the card may be covered against theft or damage for a certain period after the purchase. This provides added security for your purchases.

- Other Rewards: Apart from earning points on automotive-related expenses, the card may offer rewards on various categories such as dining, entertainment, and shopping, enhancing the overall cardholder experience.

Who Should Consider Citibank Drivers Edge?

Young Professionals

If you’re embarking on your professional journey, the Citibank Driver’s Edge card can be a valuable companion. It allows you to earn rewards on your daily expenses, helping you get more out of your spending. Additionally, responsible use of the card can assist in building a positive credit history, setting a strong foundation for your financial future.

Regular Commuters

For those who find themselves frequently on the road, either for work or leisure, the Citibank Driver’s Edge card can be particularly rewarding. You can earn points on fuel purchases, as well as on maintenance and other automotive-related expenses. This makes it easier to offset some of the costs associated with commuting or travel by car.

Travel Enthusiasts

If you have a passion for travel, the Citibank Driver’s Edge card offers travel rewards and perks that can enhance your journeys. Whether you’re booking flights, hotels, or other travel-related expenses, you can earn points that can be redeemed to reduce your travel costs. Plus, with travel insurance benefits, you can travel with added peace of mind knowing you’re covered for unforeseen circumstances.

Comparing Citibank Drivers Edge with Other Cards

1. Cashback vs Points:

- Cashback Cards: These cards offer immediate savings by giving you a percentage of your spending back in cash. While this can be straightforward and easy to understand, the rewards are typically fixed and may not offer as much value for certain types of spending.

- Points Cards (Citibank Driver’s Edge): Cards like the Citibank Driver’s Edge offer points for your purchases, which can be redeemed for various rewards. This includes not only cash but also travel rewards, merchandise, and more. Points cards often provide greater flexibility and can offer higher value, especially for those interested in travel rewards.

2. Interest Rates and Fees:

- Citibank Driver’s Edge: This card offers competitive interest rates, making it a suitable option for those who may carry a balance. Additionally, it comes with no annual fee, reducing the overall cost of maintaining the card.

- Other Cards: Some cards may come with higher interest rates or annual fees, which can add to the cost of using the card. Comparatively, the Citibank Driver’s Edge stands out as a cost-effective choice.

3. Additional Benefits:

- Citibank Driver’s Edge: Beyond rewards, this card offers a range of additional benefits such as purchase protection, travel insurance, and more. These perks can provide added value and peace of mind to cardholders.

- Other Cards: While many cards offer rewards, not all provide additional benefits like purchase protection or travel insurance. The comprehensive set of benefits offered by the Citibank Driver’s Edge can make it a more appealing option for those seeking added security and convenience.

Tips to Maximize Your Citibank Drivers Edge Rewards

Using the Card for Daily Expenses

- Everyday Spending: Make it a habit to use your Citibank Drivers Edge card for all your daily purchases. Whether it’s groceries, dining out, or filling up your gas tank, each transaction can accumulate points.

- Track Your Spending: Monitor your spending to ensure you stay within your budget while maximizing your rewards. Using the card responsibly will help you avoid unnecessary fees and interest charges.

- Set up Auto-Pay: To avoid late fees and maintain a good credit score, consider setting up auto-pay for your Citibank Drivers Edge card. This ensures that your bill is paid on time, allowing you to focus on earning rewards.

Taking Advantage of Promotions

- Stay Informed: Keep yourself updated on the latest promotions or partner offers from Citibank. This can be through email notifications, the Citibank website, or their mobile app.

- Timing is Key: Some promotions may be seasonal or limited-time offers. Plan your purchases around these promotions to earn bonus points or cash back.

- Maximize Bonus Categories: Some promotions might offer extra points for specific categories like dining, travel, or online shopping. Utilize these categories to earn additional rewards on top of your regular points.

Avoiding Common Mistakes

- Pay Your Balance in Full: To maximize the value of your rewards, aim to pay off your balance in full each month. This avoids accruing interest, which can negate the benefits of earning points.

- Avoid Cash Advances: Using your Citibank Drivers Edge card for cash advances often comes with high fees and interest rates. It’s best to avoid this feature unless absolutely necessary.

- Monitor Your Points: Regularly check your rewards balance to ensure all your points are being credited correctly. Report any discrepancies to Citibank’s customer service to resolve them promptly.

By following these tips, you can make the most out of your Citibank Drivers Edge card and enjoy the rewards it offers. Happy earning!

Customer Reviews and Feedback

Positive Feedback

- Flexibility: Customers consistently praise the Citibank Drivers Edge card for its flexibility. The ability to earn rewards on a wide range of purchases, from daily expenses to larger investments, is highly valued.

- No Annual Fee: The absence of an annual fee is a major attraction for many customers. It eliminates an extra cost and makes the card more accessible to a broader range of users.

- Competitive Interest Rates: Many customers appreciate the competitive interest rates offered by Citibank Drivers Edge. This feature makes it easier for cardholders to manage their finances and pay off balances without accruing high interest charges.

- Reward Redemption Options: The variety of redemption options available, such as statement credits, travel bookings, and merchandise, is another aspect customers love. This flexibility allows cardholders to choose rewards that best suit their needs and preferences.

Areas of Improvement

- More Bonus Categories: Some customers have expressed a desire for Citibank to introduce additional bonus categories. While the existing categories are appreciated, expanding them could provide more opportunities to earn bonus points on different types of spending.

- Higher Earning Rates: A common suggestion from customers is to increase the earning rates, either overall or within specific categories. By offering higher points per dollar spent, customers feel they could earn rewards more quickly and maximize their benefits.

- Improved Customer Service: While the majority of customers are satisfied with the service, there are some who feel that customer service could be improved. Faster response times and more knowledgeable support representatives would enhance the overall customer experience.

- Clearer Terms and Conditions: A few customers have mentioned that the terms and conditions, particularly regarding promotions and bonus categories, could be clearer. Simplifying and clarifying these terms would help customers better understand how to earn and redeem rewards.

Applying for Citibank Drivers Edge

Eligibility Criteria

- Age Requirement: Applicants must typically be at least 18 years old to apply for the Citibank Drivers Edge card. Some regions or countries may have a different minimum age requirement, so it’s essential to check the specific criteria for your location.

- Income Requirement: Citibank may have a minimum income requirement that applicants need to meet to be eligible for the Drivers Edge card. This requirement helps ensure that applicants have the financial means to manage a credit card responsibly.

- Credit History: A good to excellent credit score is usually preferred for approval. Citibank will likely check your credit history to assess your creditworthiness.

- Residency Status: You’ll need to be a resident of the country where you’re applying for the Citibank Drivers Edge card. Proof of residency may be required during the application process.

Application Process

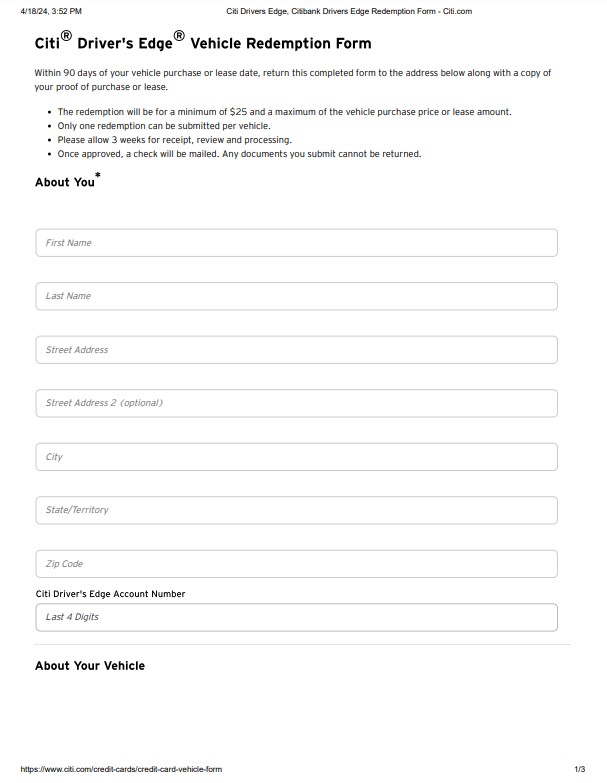

- Online Application: You can apply for the Citibank Drivers Edge card online through Citibank’s official website. The online application is user-friendly, and you’ll need to fill out personal and financial information, including your name, address, income details, and employment information.

- In-Branch Application: If you prefer a more personal touch or need assistance with the application process, you can visit a Citibank branch to apply in person. A representative will guide you through the application and answer any questions you may have.

- Required Documents: Depending on your application, you may need to provide supporting documents such as proof of identity, proof of income, and proof of residency. Make sure to have these documents ready to expedite the application process.

Approval Timeframe

- Immediate Approval: In some cases, you may receive instant approval after submitting your online application. This is more likely if you meet all the eligibility criteria and have a strong credit history.

- Delayed Approval: If further verification or review is required, approval may take a few days. During this time, Citibank may contact you for additional information or documentation.

- Check Application Status: After submitting your application, Citibank will provide you with a way to check your application status online or via phone. It’s a good idea to monitor your application status regularly for updates on approval or any additional requirements.

Managing Your Citibank Drivers Edge Account

Online Banking Features

- Account Overview: Citibank’s online banking platform provides a comprehensive view of your Citibank Drivers Edge account. You can easily check your balance, view transaction history, and monitor your rewards points.

- Bill Payments: Paying your Citibank Drivers Edge credit card bill is hassle-free with online banking. You can schedule one-time payments or set up automatic payments to ensure your bills are paid on time every month.

- Transaction Alerts: Set up customizable alerts to stay informed about your account activity. Whether it’s a large purchase, a payment due date, or a reward redemption opportunity, alerts can help you manage your account more effectively.

- Mobile App: Manage your account on the go with Citibank’s mobile banking app. The app offers most of the features available on the desktop version, making it convenient to manage your Citibank Drivers Edge account from anywhere.

Payment Options

- Online Payments: The most convenient way to pay your Citibank Drivers Edge bill is through the online banking platform. Simply log in to your account, select the ‘Pay Bill’ option, and follow the instructions to make a payment from your linked bank account.

- Automatic Payments: To avoid missing payments and late fees, consider setting up automatic payments. You can choose to pay the minimum amount due, the full balance, or a custom amount each month.

- Payments by Mail: If you prefer traditional methods, Citibank also accepts payments by mail. Ensure you include your account number on the check and allow sufficient time for the payment to reach Citibank before the due date.

Security Measures

- Fraud Alerts: Citibank employs sophisticated fraud detection systems to monitor your account for suspicious activity. If any unusual transactions are detected, you’ll receive a fraud alert via email, text, or phone call.

- Secure Online Transactions: Citibank uses encryption and other security measures to protect your personal and financial information when you conduct transactions online. Look for the ‘https://’ and padlock symbol in your browser to ensure you’re on a secure page.

- Identity Verification: To further enhance security, Citibank may require additional verification steps when accessing your account or making certain transactions. This could include entering a one-time passcode sent to your registered mobile number or answering security questions.

Conclusion

Citibank Drivers Edge offers a rewarding experience for drivers looking to earn points on their everyday expenses. With no annual fee, competitive interest rates, and a range of additional perks, it’s a great option for those looking to maximize their rewards. Whether you’re a young professional, a regular commuter, or a travel enthusiast, Citibank Drivers Edge has something to offer.

Download Citibank Drivers Edge

FAQs

- What is Citibank Drivers Edge?

- Citibank Drivers Edge is a credit card designed to reward drivers for their everyday expenses with points that can be redeemed for various rewards.

- Does Citibank Drivers Edge have an annual fee?

- No, Citibank Drivers Edge does not have an annual fee.

- How can I earn points with Citibank Drivers Edge?

- You can earn points by using your Citibank Drivers Edge card for everyday purchases and taking advantage of bonus point opportunities.

- Can I redeem my Citibank Drivers Edge points for cashback?

- Yes, you can redeem your points for cashback, travel vouchers, merchandise, and more.

- Is Citibank Drivers Edge a good option for travel rewards?

- Yes, Citibank Drivers Edge offers travel rewards and perks, making it a great option for travel enthusiasts.